will county illinois property tax due dates 2021

2 nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per month post-mark accepted. 1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted.

Property Taxes Could Soar 30 To 50 Business Jhnewsandguide Com

Welcome to Property Taxes and Fees.

. Tax amount varies by county. In this new world of social distancing we are offering alternate methods to pay taxes Real estate tax bills will be mailed beginning on May 1 and the first installment payment will be due June 3. Friday October 1 2021.

The original due date to file and pay Illinois individual income tax for calendar year filers is April 18 2022. By August 3 2021 all but half of the First Installment will have been paid. Will County Treasurer Tim Brophy said the board should establish June 3 Aug.

County on or after July 1 2021. Kane county illinois property tax due dates 2021 Friday May 13 2022 Edit. Will County collects on average 205 of a propertys assessed fair market value as property tax.

Illinois property tax due dates 2021. Tuesday March 1 2022. A late penalty increases the penalty by 1 point.

Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. Please make sure the Supervisor of Assessments has your most current address on file. Due dates will be as follows.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Last day to submit changes for ACH withdrawals for. If you have not received your tax bill please verify your.

Will County Property Tax Bill Due Dates 2021. Tax Year 2020 Second Installment Due Date. 30 rows Real Estate Property Tax Bills Mailed.

Visit our office Monday through Friday from 830 am to 430 pm. 173 of home value. Make check payable to.

Brophy is encouraging all residents to use one of the alternate methods to pay taxes rather than come to the office and waiting in often long lines. First Date for Filing. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

All real estate not exempted is required to be taxed. Grundy County Collector has mailed mobile home tax bills with payment due date of June 1 2021. Real estate tax bills mailed earlier june and first due date of july 23 2021 and second due date of september 23 2021.

For your convenience payments may be mailed directly to PO Box 689 Morris or made in person at the courthouse located at 111 E. Tuesday March 2 2021. Sub-tax payments will be accepted starting mid-September.

In Cook County the first installment is due by March 1. A May 2 2022 postmark will be considered on time Late charges will begin on May 3 2022. And Have a total household income as defined below no greater than 65000 in 2020.

1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted. The First Installment of 2020 taxes is due March 2 2021 with application of late charges moved back to May 3 2021. In Cook County the first installment is due by March 1.

3 as the due dates for 2021. Important message regarding the taxes paid to Claypool Drainage District Pay 2021 Taxes. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a.

Contact the Treasurers Office for exact dates. Real Estate Taxes due dates are as close to June 1st and. Tax Year 2021 First Installment Due Date.

672022 2nd Installment Due. Taxes on real estate will be collected in June 2019. If you have any further questions please call us at 217 384-3743 or email us at treasurercochampaignilus.

The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. 2021 Real Estate Tax Calendar payable in 2022 May 2nd. Under this system the first installment of taxes is 55 percent of last years tax bill.

The first installment will be due on or before June 1 2021 and the second installment will be due on or before Sept. JULY 8 2021. Will County Real Estate Tax Due Dates.

Real estate tax bills mailed earlier june and first due date of july 23 2021 and second due date of september 23 2021. Illinois property tax due dates 2021. 2020 payable 2021 Real Estate collections.

Property tax bills mailed. Will County Taxes Due Date 2021. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

This installment is mailed by January 31. By the end of the first installment which runs June 3 through June 15 2021. Will County Taxes Due Date 2021.

Tax Year 2020 First Installment Due Date. Late Payment Interest Waived through Monday May 3 2021. Elsewhere a county board may set a due date as late as June 1 The second installment is prepared and mailed by June 30 and is for the balance of taxes due.

Longtime Homeowner Exemption Cook County Assessor S Office

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

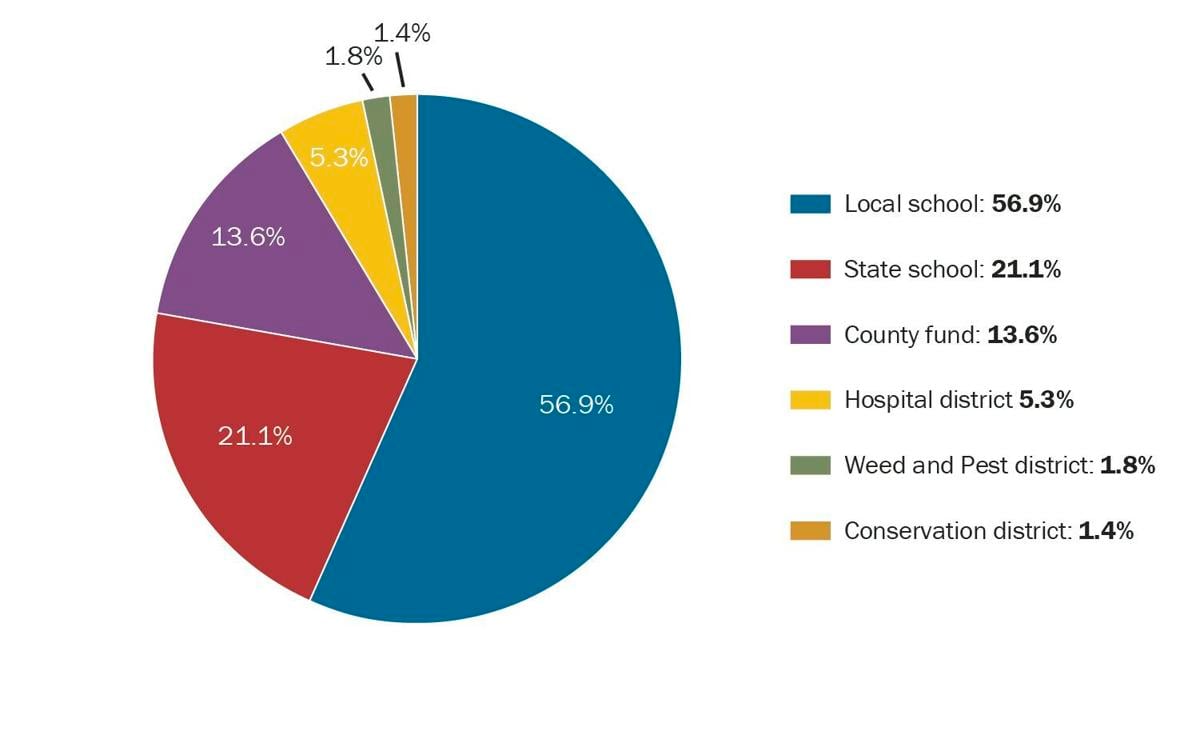

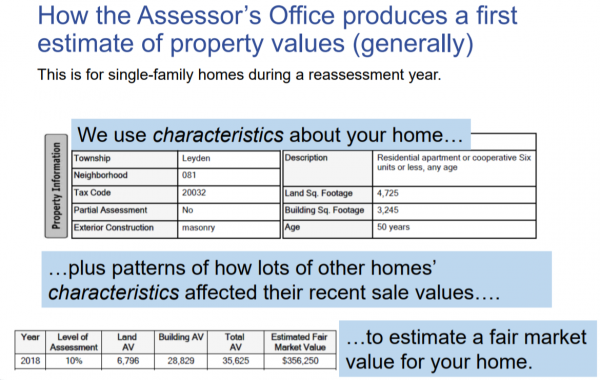

The Cook County Property Tax System Cook County Assessor S Office

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

How Residential Property Is Valued Cook County Assessor S Office

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

The Cook County Property Tax System Cook County Assessor S Office

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Cook County Assessor S Office Assessorcook Twitter

Volusia County Property Appraiser How To Check Your Property S Value

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation